How Much Charity Can You Deduct In 2025. The charitable contributions deduction allows taxpayers to deduct donations of cash and property given to qualified charitable organizations. For example, if you had $10,000 in extra donations in 2022, you can use it in 2023, 2024, 2025, 2026, or 2027.

Nearly nine in 10 taxpayers now take the standard deduction and could potentially qualify to claim a limited deduction for cash contributions. The charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving.

For The 2023 Tax Year, You Can Generally Deduct Up To 60% Of Your Adjusted Gross Income (Agi) In Monetary Gifts.

The charitable contributions deduction allows taxpayers to deduct donations of cash and property given to qualified charitable organizations.

This Publication Explains How Individuals Claim A Deduction For Charitable Contributions.

If you donate to charity, not only are you doing a good deed, but you might also qualify for a tax break.

How Much Charity Can You Deduct In 2025 Images References :

Source: www.pinterest.com

Source: www.pinterest.com

Can You Deduct Expenses of Volunteering for Charity?, How much can i deduct from donations? Your deduction may be further limited.

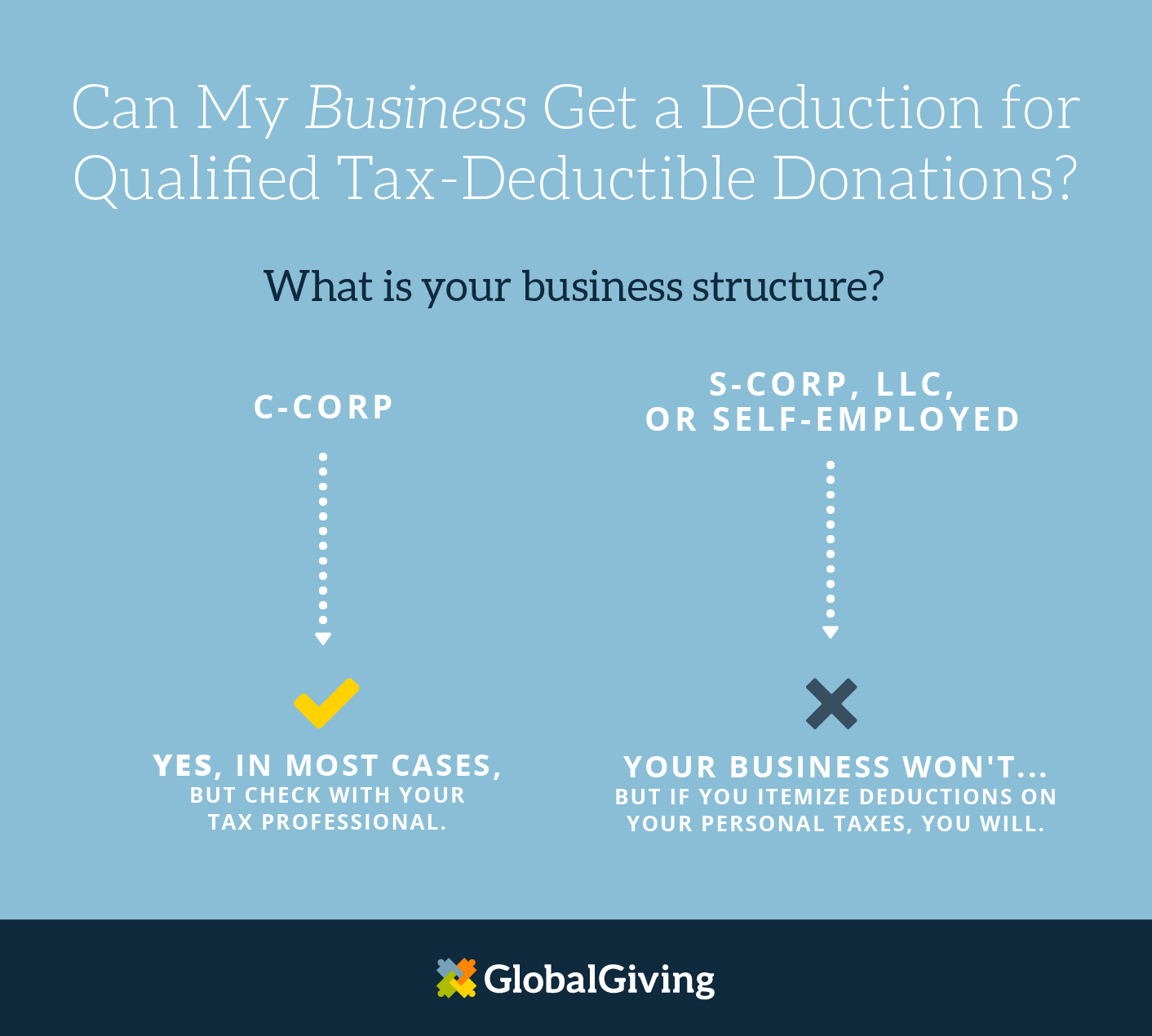

Source: www.globalgiving.org

Source: www.globalgiving.org

Everything You Need To Know About Your TaxDeductible Donation Learn, Generally, you can deduct all your charitable contributions for the year as long as they do not exceed 20% of agi. Generally, you can deduct your donations up to 60% of your.

Source: www.spiral.us

Source: www.spiral.us

How Much Charity Is TaxDeductible? · Blog · Spiral, In that case, you'd claim charitable donations on schedule a (form 1040). Nearly nine in 10 taxpayers now take the standard deduction and could potentially qualify to claim a limited deduction for cash contributions.

Source: retire.ly

Source: retire.ly

This Giving Season, How Much Can You Donate and Deduct in Taxes, Gifts to individuals are not. In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50%, depending on the.

Source: www.forbes.com

Source: www.forbes.com

Giving More Than 60 Of To Charity? CARES Act Says Deduct It!, The maximum allowable donation under section 80g for institutions providing a deduction with a qualifying limit is capped at 10% of the donor’s. Gifts to individuals are not.

Source: www.ztaxllc.com

Source: www.ztaxllc.com

Your charitable donations are tax deductible… — Ztax, Corporations generally can deduct charitable gifts up to 10 percent of their taxable income in a given year. Here’s what you need to know.

Source: www.magnifymoney.com

Source: www.magnifymoney.com

The Most (And Least) Charitable Places in the U.S. MagnifyMoney, Your deduction may be further limited. The charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving.

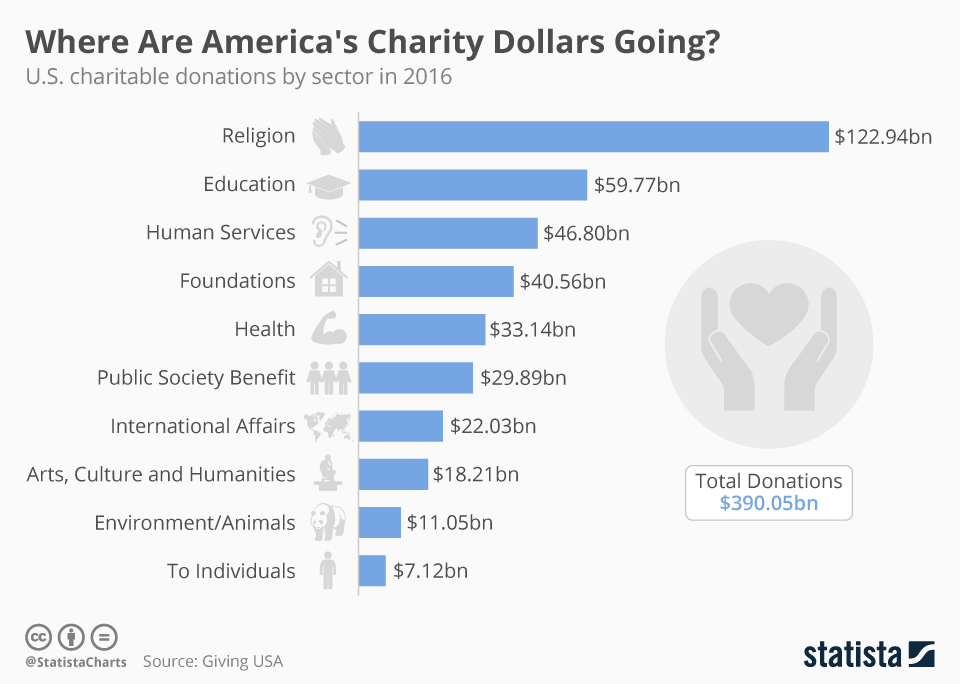

Source: www.statista.com

Source: www.statista.com

Chart Where Are America's Charity Dollars Going? Statista, The charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. 7 charitable tax deduction questions are answered in.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

How to Deduct Charitable Contributions QuickBooks, This publication explains how individuals claim a deduction for charitable contributions. The charitable contributions deduction allows taxpayers to deduct donations of cash and property given to qualified charitable organizations.

Source: www.pinterest.com

Source: www.pinterest.com

Learn which donations you can deduct from your tax return Handmade, However, in some limited cases, you can. How much can you deduct for donations?

The Tax Cuts And Jobs Act, Which Affects The 2018 To 2025 Tax Years, Significantly Increased The Standard Deduction Amount.

Corporations generally can deduct charitable gifts up to 10 percent of their taxable income in a given year.

Treasury Laws Amendment (Support For Small Business And Charities And Other Measures) Act 2024

The amount you can deduct for charitable contributions generally is limited to no more than 60% of your adjusted gross income.