Social Security Medicare Tax Rate 2024. Federal payroll tax that plays a critical role in funding social security and medicare programs. 2024 social security and medicare tax withholding rates and limits.

6.2% social security tax on the first $168,600 of wages (6.2% x $168,600 makes the maximum tax $10,453.20), plus. 6.2% for the employee plus 6.2% for the employer;

Social Security Medicare Tax Rate 2024 Images References :

Source: adrianawmabel.pages.dev

Source: adrianawmabel.pages.dev

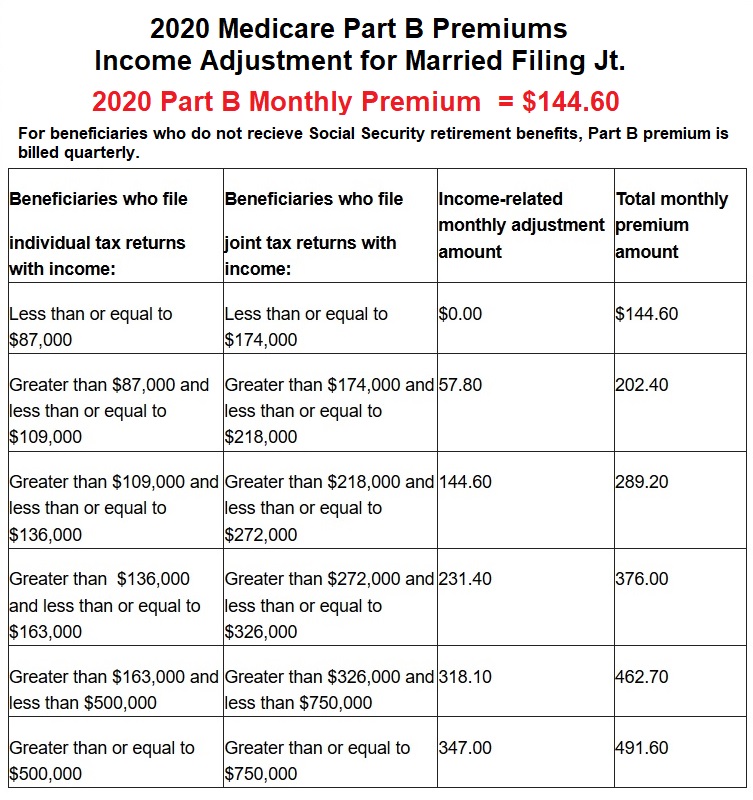

2024 Medicare Tax Rates And Limits Flori Jillane, 1.45% for the employee plus 1.45%.

Source: kerrillwedie.pages.dev

Source: kerrillwedie.pages.dev

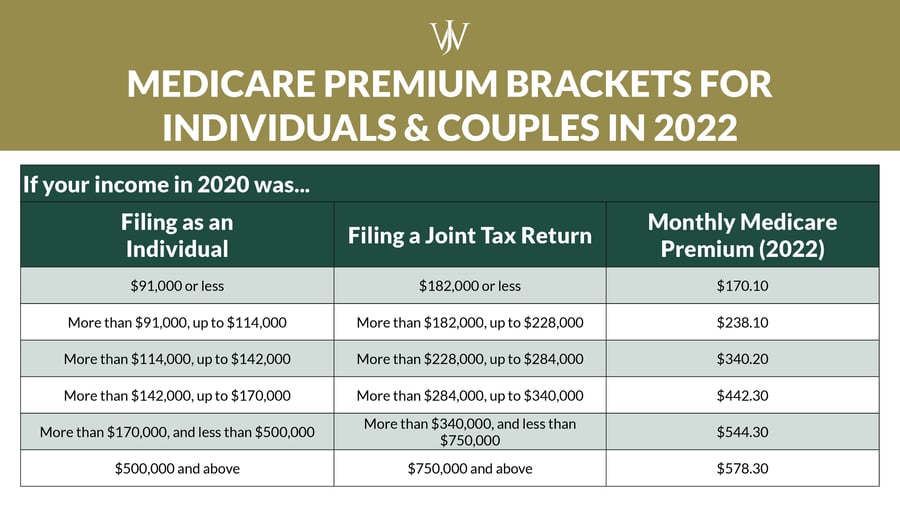

2024 Medicare Surcharge Brackets Nona Thalia, 6.2% for the employee plus 6.2% for the employer;

Source: jeanneymandie.pages.dev

Source: jeanneymandie.pages.dev

Medicare Limits 2024 Chart Pdf Licha Othilie, In 2024, the threshold goes up to $168,600.

Source: celiebrebbecca.pages.dev

Source: celiebrebbecca.pages.dev

2024 Max Social Security Tax By Year Usa Patsy Bellanca, For 2024, an employer must withhold:

Source: adrianawmabel.pages.dev

Source: adrianawmabel.pages.dev

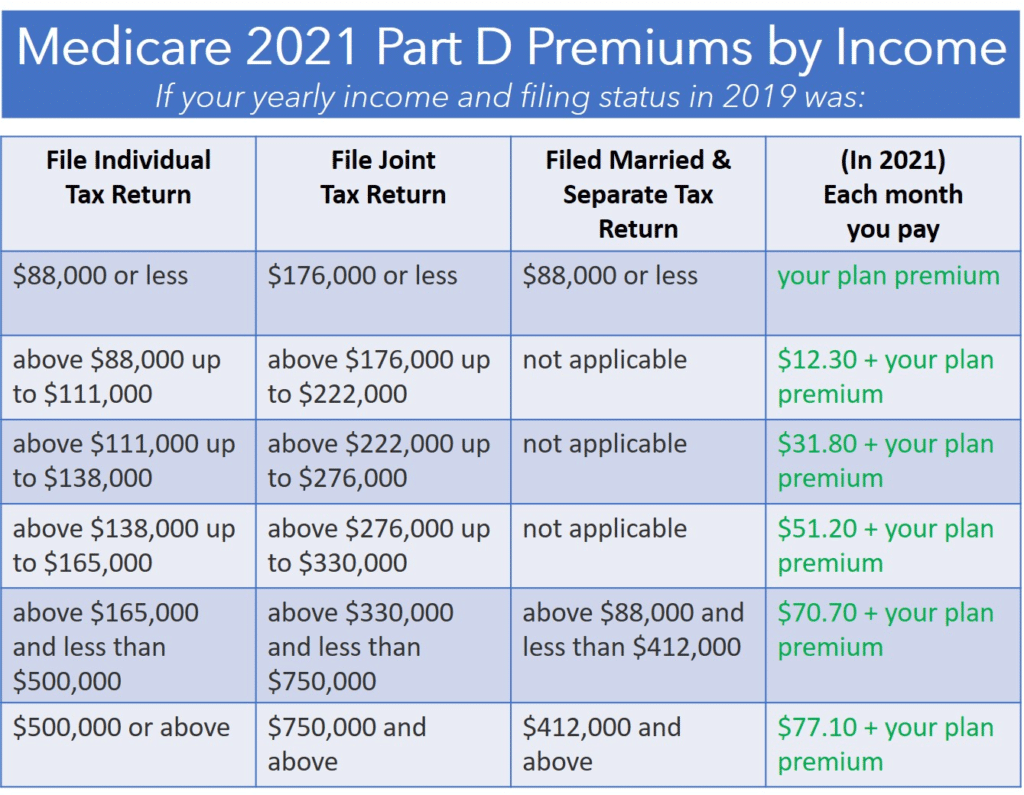

2024 Medicare Tax Rates And Limits Flori Jillane, To determine whether you are subject to irmaa charges, medicare uses the.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

The 2024 IRMAA Brackets Social Security Intelligence, 6.2% for both the employer.

Source: addiejenica.pages.dev

Source: addiejenica.pages.dev

Medicare Limits 2024 Chart Pdf Linn Shelli, To determine whether you are subject to irmaa charges, medicare uses the.

Source: viviaychrystal.pages.dev

Source: viviaychrystal.pages.dev

2024 Tax Rates And Deductions Available Tessi Gerianne, For 2024, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Source: matricbseb.com

Source: matricbseb.com

Social Security Tax Limit 2024 All You Need to Know About Tax Limit, 1.45% for the employee plus 1.45%.

Max Social Security Tax 2024 Withholding Amount Adele Antonie, 2% social security tax on the first $168,600 of wages (6.2% x $168,600 makes the maximum tax $10,453.20), plus.

Category: 2024